Taxability of Capital Gain on Transfer of Agricultural Land | Capital gain, Capital gains tax, Agricultural land

USDA ERS - ERS Modeling Shows Most Farm Estates Would Have No Change in Capital Gains Tax Liability Under Proposed Changes

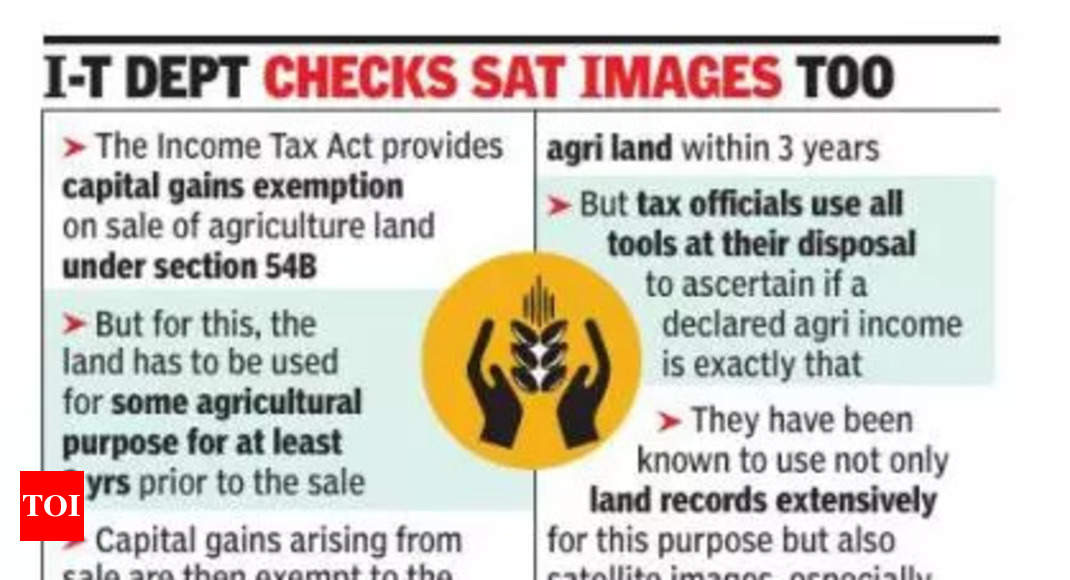

Section 54B - Capital Gains Exemption on Sale of Agricultural Land - Income from Capital Gains - TaxQ&A by Quicko - Get answers to all tax related queries

Buy Capital Gain on Sale of Agricultural land and tax planning for Agricltural Income Book Online at Low Prices in India | Capital Gain on Sale of Agricultural land and tax planning

Consideration from sale of urban agricultural land is subject to capital gains tax: ITAT upholds revision proceedings u/s 263 of Income Tax Act

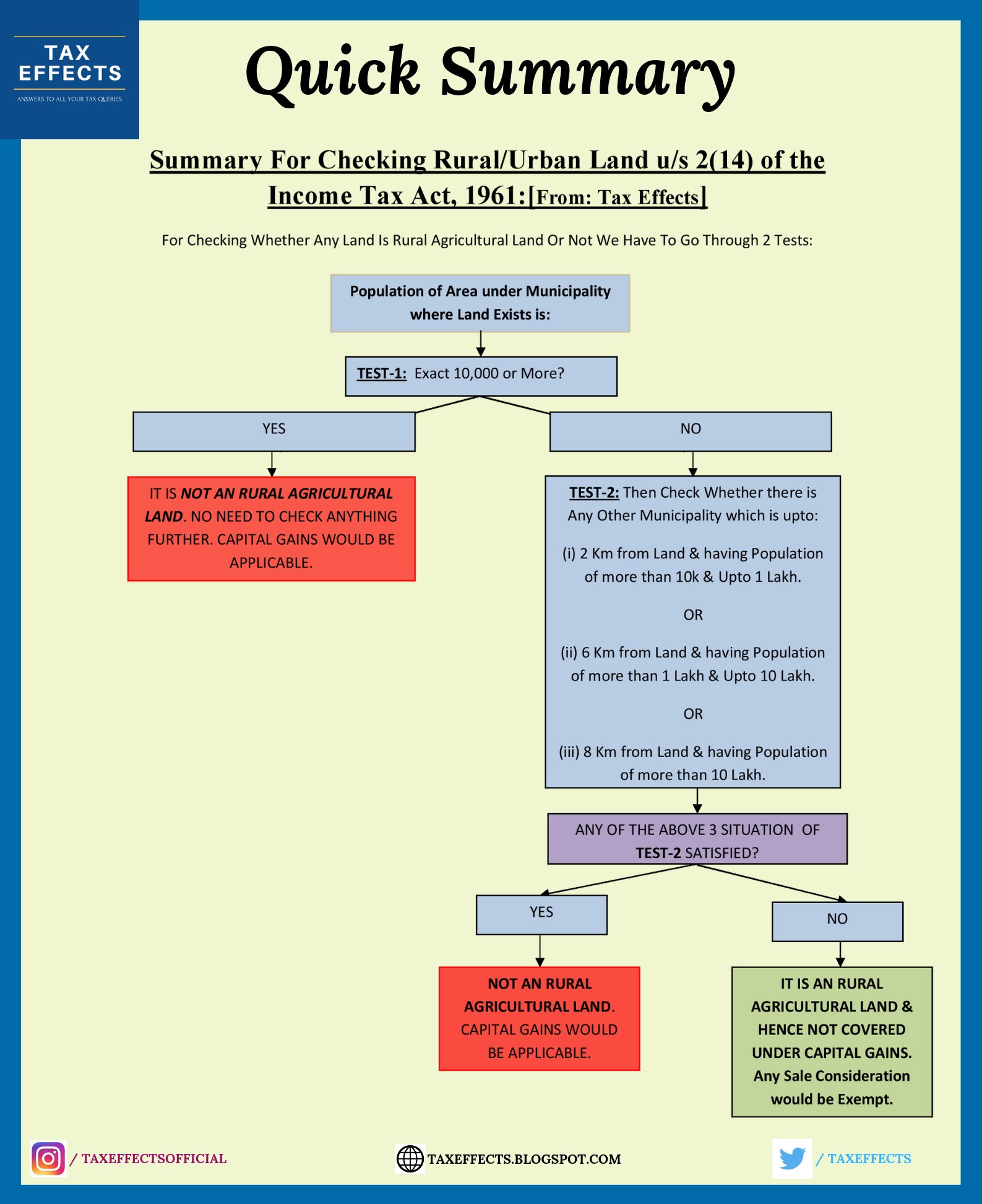

Tax Effects on X: "Whether any land is Rural or Urban as per income tax act, Check it instantly through this chart. #taxeffects #tax #incometax #summary #ca #castudents #cs https://t.co/eQlY4ktzYJ" / X

🌾💰 Unlocking the Secrets of Capital Gains Tax on Agricultural Land in India! 🏞️🏙️ Whether you're a farmer or an urban investor eyeing rur… | Instagram

ITR Filing 2024: Capital Gains Tax - THIS type of agricultural land sale is NOT chargeable to income tax | Income Tax News, ET Now